USDA Money

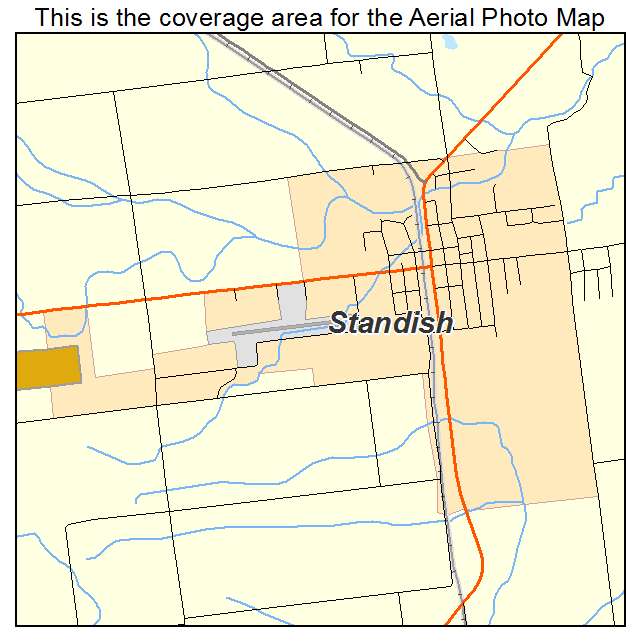

Even although you don’t believe an excellent USDA loan can be found in order to your because you you should never live in a rural neighborhood, you’re shocked to determine your qualify. More individuals normally be eligible for which bodies-covered loan system than you may believe.

Even if you live-in a residential district society, you could find your location enables you to entitled to which variety of mortgage.

Brand new USDA now offers home loans to those which have down borrowing from the bank results. The home should be the majority of your quarters, can’t be a working farm, and start to become from inside the great condition to fulfill this new USDA’s lowest property standards.

No off money

Including Virtual assistant finance, you can purchase home financing rather than an advance payment requirement courtesy the newest USDA. Whenever you are you will find an upfront make sure percentage, there is no need to invest in which expenses.

Debt-to-earnings conditions

So you’re able to be eligible for these home loan, your debt-to-earnings proportion can not be more than 43%. This profile comes with mortgage payments, including another obligations money versus the disgusting monthly income.

Money limits

Such financing can handle individuals with lower otherwise moderate income. It is recognized as a full time income which is less than 115% of your own median money in your neighborhood. This consists of the amount of money of all of the people who find themselves planning to inhabit the home, that it is a more difficult maximum than it very first seems.

Borrowing from the bank requirements

The fresh new USDA has a tendency to provides less restrictions stopping you against to buy a property when you have bad credit. When you have had later repayments prior to now, and this took place more this past year, he could be more likely to be overlooked during underwriting.

Even although you don’t have old-fashioned sourced elements of borrowing, new underwriter might use their commission history so you can energy or cash loan Upper Witter Gulch cellular telephone enterprises. They may even use deposits with the saving membership to evaluate the chance you show the financial institution. not, that it merely happens up until now, and if you may have negative credit, you will probably find challenging is approved.

Financial Insurance coverage

When you get a loan through the USDA, you will need to spend mortgage insurance policies. There will additionally be a hope percentage that is step one% of the amount borrowed, although this is exactly placed into the loan and reduced gradually.

To your an excellent harmony of your home loan, you are going to need to pay 0.35% yearly, spread across the one year. Which percentage can be less than FHA financial insurance costs.

USDA money may also not be useful for 2nd home and you may resource features. Your house will also need to be appraised to meet the newest USDA’s minimum possessions criteria. And if you’re looking to buy a house that needs recovery, almost every other loans was a better choices.

The USDA has actually limits on your own money should you want to score that loan as a consequence of their system. Which limitations their mortgages to help you home buyers that have reasonable earnings.

If you are looking to acquire property for the an urban city, these types of loan are unlikely as out there. While they do safeguards many portion that you wouldn’t believe was thought outlying, urban residential property are not going to meet the requirements.

Brand new USDA system doesn’t provide cash-aside refinancing. If you are looking so you can refinance or take several of your own equity while the cash, you will have to choose another type of loan.

Summing-up FHA, Va and USDA Variations

When you’re to purchase property, there’s a high probability you will be eligible for certainly these types of bodies-covered programs. They all features pros in addition to some examples in which it are not quite as an effective.